How do I pay myself as an Australian business owner?

Over the course of your entrepreneurial journey, understanding how to pay yourself as an Australian business owner is crucial to ensure your financial stability and compliance with tax regulations. You have multiple options, including salary, dividends, or drawings, each with its own implications for your business structure and tax obligations. This guide aims to simplify the process, empowering you to make informed decisions about compensating yourself while maintaining the long-term health of your business.

Key Takeaways:

- Business Structure: Choose the right business structure (e.g., sole trader, partnership, company) as it impacts how you can pay yourself.

- Draw vs Salary: Determine whether to take a draw (for sole traders) or a salary (for employees of your own company), as each has different tax implications.

- Tax Obligations: Understand your tax obligations, including superannuation contributions and PAYG withholding, to avoid potential issues with the ATO.

Types of Payments

A variety of payment methods exist for Australian business owners to pay themselves, each with its own advantages and tax implications. Understanding these options is vital for effective financial management.

- Salary

- Dividends

- Drawings

- Bonuses

- Fringe Benefits

After evaluating your business structure and financial situation, you can choose the most suitable payment method.

| Payment Type | Details |

| Salary | Regular payment from business profits, subject to withholding tax. |

| Dividends | Distribution of profits to shareholders, typically taxed at a different rate. |

| Drawings | Withdrawals from business profits, mainly for sole traders and partnerships. |

| Bonuses | Additional payments often based on performance or profits. |

| Fringe Benefits | Non-cash benefits provided to you as an employee of your business. |

Salary

One of the most common methods to pay yourself is through a salary, which is a fixed, regular payment made from your business profits. This method allows for predictable income and helps you maintain a steady cash flow.

Dividends

To pay yourself via dividends, your business needs to be structured as a company. This involves distributing profits to shareholders, which could provide tax advantages depending on your overall income situation.

Plus, dividends can be an effective way to access your profits while potentially benefiting from franking credits, which can reduce your tax liability on the income received. It’s vital to ensure that there are sufficient profits available for distribution before declaring dividends.

Drawings

Assuming you operate as a sole trader or in a partnership, you can opt for drawings. Drawings represent funds you take from the business for personal use, typically not classified as a salary or wage.

It is important to track your drawings accurately since excessive withdrawals could impact your business cash flow and financial stability. Regularly reviewing your profits and ensuring adequate funds remain in the business is vital to sustaining your operations.

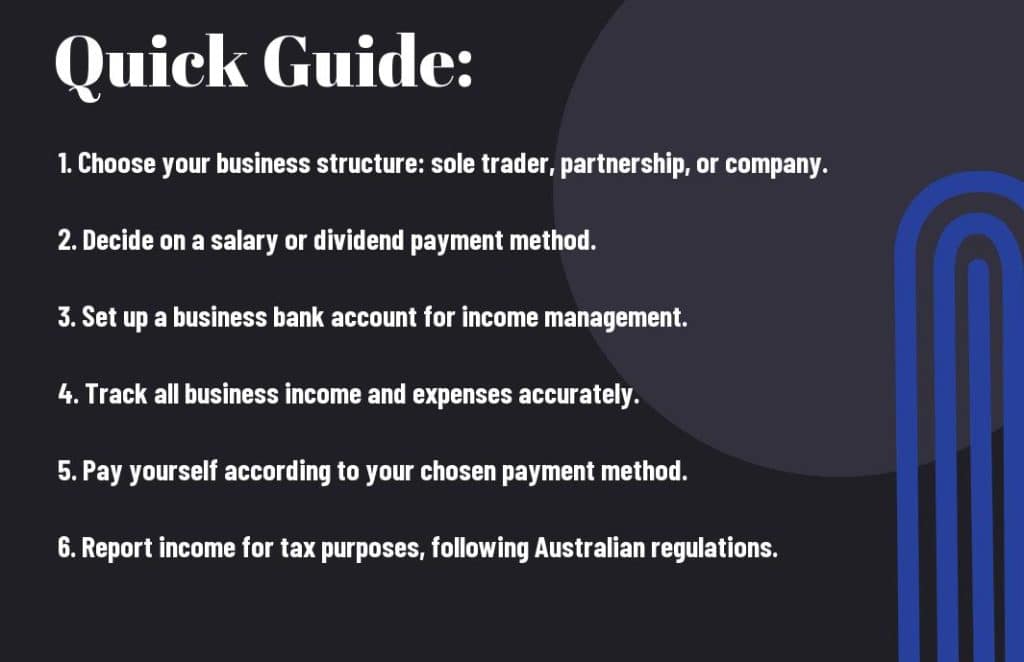

Step-by-Step Guide

One straightforward approach to paying yourself as an Australian business owner involves several key steps outlined in the table below.

| Step | Description |

|---|---|

| 1 | Choose your payment method. |

| 2 | Establish a business bank account. |

| 3 | Determine your salary or draw amount. |

| 4 | Set up proper accounting for tax purposes. |

| 5 | Regularly transfer funds to your personal account. |

Setting Up Your Payment Method

Method selection is imperative for smooth financial management. You can opt to pay yourself via payroll, dividends, or owner’s draws, depending on your business structure. Each option has its benefits, and choosing the right one can streamline your financial process and ensure tax compliance.

Understanding Tax Obligations

Guide your financial decisions by understanding your tax obligations. As a business owner, you are responsible for reporting your income and paying taxes on it. Different payment methods will have varying implications on tax rates and obligations, so it’s important to consult a tax professional to navigate these requirements effectively.

It is vital to stay informed about your tax responsibilities to avoid penalties. Depending on your business structure, you may be required to pay income tax on your salary, GST on sales, and other tax obligations, such as superannuation contributions. By keeping meticulous records and consulting with a tax advisor, you can ensure compliance and optimize your tax position.

Factors to Consider

After determining how to pay yourself, consider these vital factors:

- Business structure

- Tax implications

- Cash flow

- Profit margins

Thou must evaluate these elements to ensure a well-rounded approach to your compensation strategy.

Business Structure

Even if you run a sole proprietorship, partnership, or company, your business structure influences how you pay yourself. Each structure has different legal and tax implications that can impact your income and how funds are distributed. Understanding these aspects can help maximize your earnings while minimizing liabilities.

Profit Margins

Structure your compensation around your profit margins. This approach helps ensure that you can sustain a reasonable income while keeping your business finances healthy. Consider how much profit your business generates and set your salary in line with these figures to avoid cash flow strain.

Understanding your profit margins is vital for long-term success. Regularly review your financial statements to gauge how much profit you consistently make. This knowledge will empower you to make informed decisions about your salary, allowing you to strike a balance between rewarding yourself and re-investing in your business for future growth.

Pros and Cons

Keep in mind that choosing how to pay yourself as a business owner involves weighing the pros and cons. Understanding these factors will help you make informed decisions that align with your business structure and financial goals.

Pros and Cons of Different Payment Methods

| Pros | Cons |

|---|---|

| Flexibility in salary or dividends | Potential for tax liabilities |

| Easier cash flow management | Complex accounting requirements |

| Retained earnings for reinvestment | Impact on personal income stability |

| Legal compliance with various structures | Limitations based on business structure |

| Opportunity to maximise tax advantages | Possibly higher administration costs |

Advantages of Different Payment Methods

Now, understanding the advantages of various payment methods can help you optimise your income strategy. For example, drawing a salary may provide regular cash flow, while dividends can offer tax benefits. Each method can be tailored to your financial situation, ultimately aiding in personal financial planning.

Disadvantages to Consider

There’s no perfect solution when it comes to paying yourself. Different payment methods come with their own set of drawbacks that you must consider to ensure you’re making the best choice for your business.

A common disadvantage is the potential for increased tax liabilities, particularly if you choose methods that may attract higher rates. Additionally, complex accounting requirements can lead to higher administrative costs, resulting in a significant amount of your time devoted to managing finances rather than focusing on growing your business. Moreover, certain payment methods might affect your personal income stability, which can add stress to your personal finances. Balancing these disadvantages with the potential benefits is important to making the best choice for your specific circumstances.

Tips for Effective Payment Strategies

Once again, implementing solid payment strategies can significantly enhance your financial management. Consider the following tips:

- Set a consistent payment schedule.

- Utilize accounting software for easy tracking.

- Separate personal and business finances.

- Regularly review your payment strategies.

Recognizing the importance of these strategies will help you maintain a sustainable business model.

Regular Review of Payment Methods

Any successful business owner should regularly assess their payment methods to ensure they align with current financial goals and market trends. This review can help you identify more efficient processes or explore new options that may enhance your cash flow and overall business performance.

Consulting with Financial Advisors

Payment methods can be complex and vary significantly based on individual business circumstances. Consulting with financial advisors can provide you with tailored advice that suits your specific needs and goals.

Financial advisors bring expertise and experience that can help you navigate the intricate world of business payments. They can assist in evaluating your current payment methods, suggesting improvements, and ensuring you’re compliant with financial regulations. By working closely with an advisor, you can develop strategies that optimize your financial resources and support your business growth.

Common Mistakes to Avoid

Not considering the complexities of your payment structure can lead to unnecessary difficulties. One common mistake is to underestimate the importance of separating personal and business finances, which can create issues with accounting and tax obligations. Ensuring you approach your income strategy thoughtfully can help you stay compliant and maintain financial clarity.

Misinterpretation of Tax Laws

Any misunderstanding of tax laws can lead to potentially costly mistakes. As an Australian business owner, it is vital to familiarize yourself with the ATO regulations regarding income and wage distributions. Misinterpreting how taxes apply to your salary may result in unexpected tax liabilities down the line.

Overlooking Personal Needs

Common oversight is failing to consider your personal financial needs while determining your salary. Balancing business expenses and personal financial obligations is important; underpaying yourself can affect your livelihood and overall well-being.

Misinterpretation of your financial situation can lead to a disconnected approach, where your business’s success does not translate into personal financial health. You must assess your living expenses, savings goals, and any investments you may have made. By doing so, you can set a salary that adequately supports your lifestyle and aligns with your business’s growth, ensuring that both you and your business thrive together.

Summing up

Considering all points, paying yourself as an Australian business owner can be approached in several ways, including salary, dividends, or drawings, depending on your business structure. It’s crucial to assess your eligibility and tax implications for each method. You should also prioritize maintaining a clear distinction between your business and personal finances to ensure compliance and simplify accounting. Consulting with a financial advisor or accountant can help you establish the most effective payment strategy that aligns with your goals and legal requirements.

FAQ

Q: How should I classify my payments to myself as a business owner in Australia?

A: As a business owner in Australia, the way you pay yourself can depend on the structure of your business. If you operate as a sole trader, you can simply withdraw money from your business account as needed, and this is considered your personal income. If you run a partnership, distributions can be made based on the partnership agreement. For companies, you typically pay yourself a salary as an employee, which means you’ll need to adhere to payroll and taxation requirements, including PAYG withholding. It’s important to consult with an accountant to determine the most tax-effective method suitable for your business structure.

Q: Are there tax implications when I pay myself as a business owner?

A: Yes, there are tax implications involved when you pay yourself as a business owner. For sole traders and partnerships, your business income is considered personal income and taxed at your individual income tax rate. If your business is a company, salary payments to yourself will be subject to PAYG withholding tax and other employee entitlements like superannuation. Additionally, company profits can be distributed as dividends, which may be taxed differently. Consulting with a tax professional can provide clarity on tax obligations and how to structure payments efficiently.

Q: How can I ensure I am adequately compensated for my work as a business owner?

A: To ensure you are adequately compensated, consider setting a regular salary or payment schedule based on the financial health of your business. Create a budget that accounts for personal living expenses and reflects the work you put into the business. It may also be beneficial to analyze industry standards for similar roles in terms of salary expectations. Periodically review your business’s profitability and adjust your payments accordingly to achieve a balance between reinvesting in the business and satisfying your personal income needs. Seek advice from a financial advisor if needed.

Source article: https://smallbiztoolbox.com.au/how-do-i-pay-myself-as-an-australian-business-owner/